Actual Cost

What is the Actual Cost?

• A calculation of how much you are spending on stock based on the sales you have achieved for the stock period.

• Expressed as an amount in £ as well as a percentage

• Also known as Actual cost of sales

How is the Actual Cost calculated?

Actual Cost = Opening Stock + Deliveries + Transfers In - Credits - Transfers Out - Closing Stock

Actual Cost Percentage = (Actual Cost / Net Sales) x 100

Why might your Actual Cost percentage be considered to be too low?

• Understated opening stock – You have entered less stock count during your last stock period than what you had in stock.

• Understated deliveries – A delivery was not entered, or an electronic invoice hasn’t arrived from the supplier yet and an accrual was not created, or the entered delivered quantities are not accurate.

• Understated transfers in – If you received stock from another location without receiving the actual transfer within Enterprise.

• Overstated credits – You requested a credit for more items than you returned.

• Overstated transfers out – Your transfer quantities are greater than the actual physical stock you sent out.

• Overstated closing stock – You have entered more stock than what you have in stock. This includes Batches.

• Under portioning – Not following the Recipes that are on Enterprise.

Why might your Actual Cost percentage be considered to be too high?

• Overstated opening stock – You have entered more stock count during your last stock period than what you had in stock. Opening stock is your closing stock from your previous stock period.

• Overstated deliveries – You have over exaggerated the delivered quantities or added items to a delivery that you did not physically receive.

• Overstated transfers in – You received a transfer from another location that includes items or more of an item that was not received.

• Understated credits – You haven’t raised a credit for items you returned, or the quantities are less than what you returned.

• Understated transfers out – You haven’t transferred out all items that you have sent to another location within the business.

• Understated closing stock – You have entered less stock count than what you actually have in stock.

• Over portioning – You have not followed the Recipes correctly and over portioned.

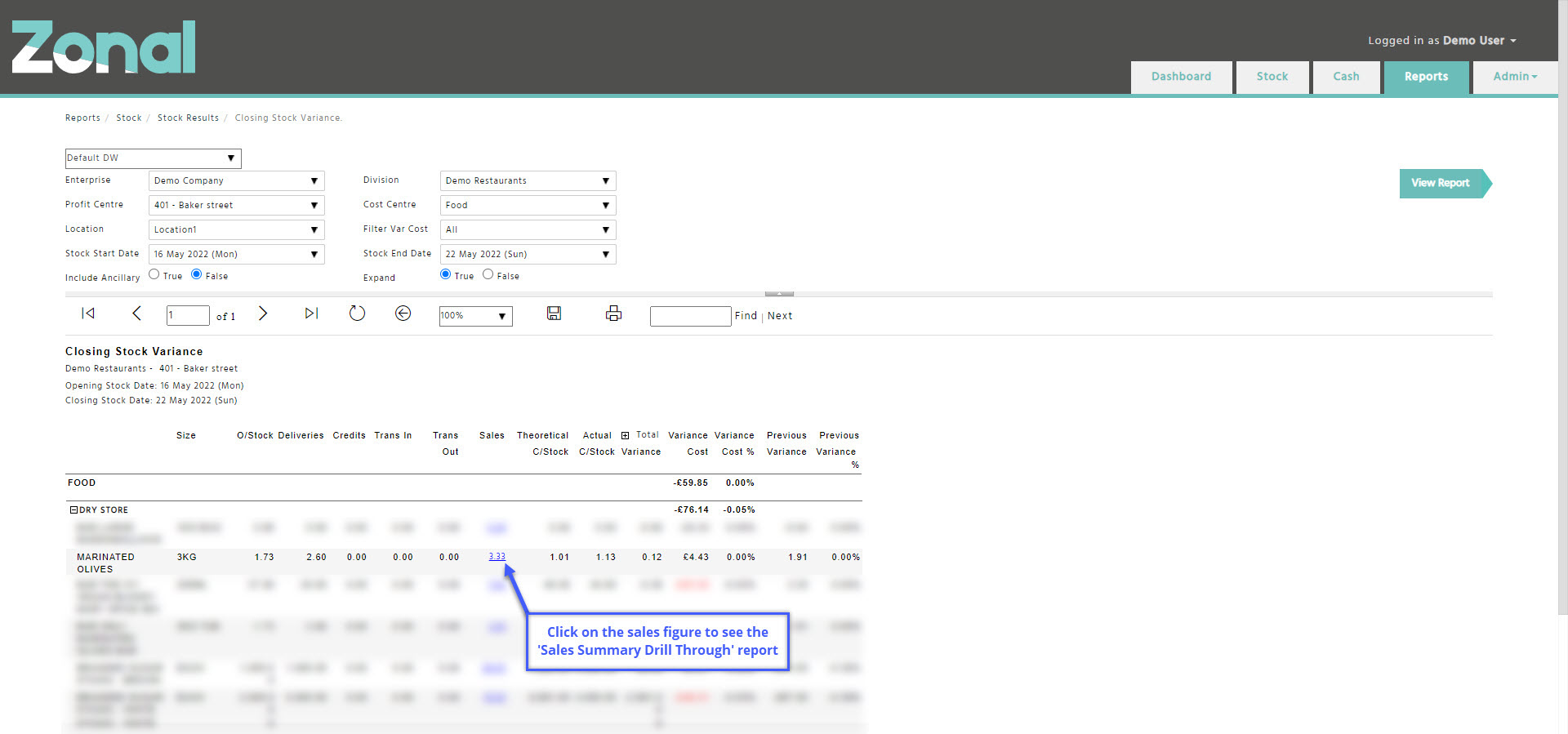

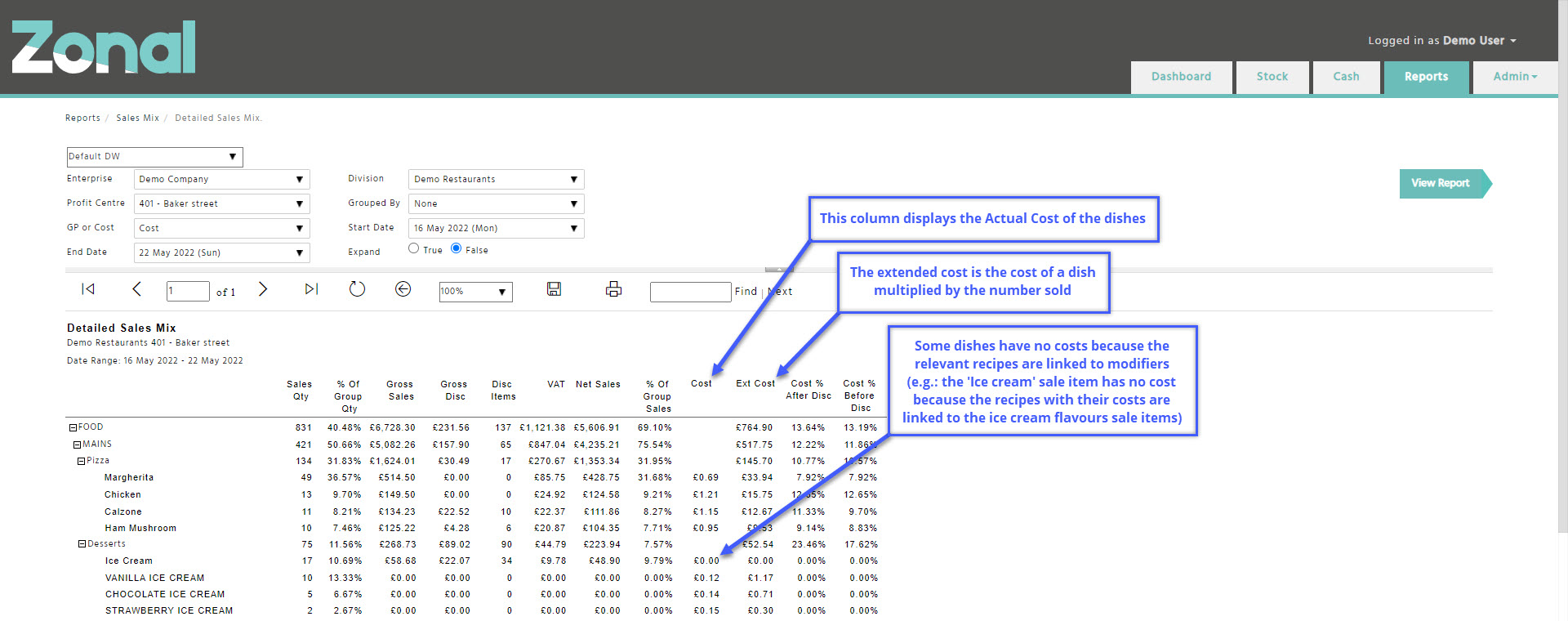

• Missing sales – Ensure that all sales have been accounted for. You can check this by running the ‘Detailed Sales Mix.’ report and evaluating the sales for a Stock Item by running the ‘Closing Stock Variance.’ report.

Theoretical Cost

What is the Theoretical Cost?

Assuming that all Recipes were made to spec and there was no wastage, the Theoretical Cost is what it should have cost your restaurant to produce all the Recipes that had been sold during a stock period based on FIFO.

How is the Theoretical Cost calculated?

Theoretical Cost = the cost of sold items based on the FIFO stack

Theoretical Cost Percentage = (Theoretical Cost / Net Sales) x 100

Why would your Theoretical Cost Percentage change?

• Price changes of Stock Items – by changing a product from one supplier to another, or by changing the cost price of a supplier product

• Recipe changes

• Sales mix – If you sold lots of expensive dishes, your percentage would increase, however, you could have increased your sales considerably.

• The use of discounts – Since you are taking less money but producing the same dishes, however, you could have increased your sales considerably.

• Missing sales

Stock Valuation and Stock Variances

How is the stock valued?

The system calculates the value of your stock at the end of a stock period on a ‘First In, First Out’ basis so if the price of an item increases, it will assume that the cheapest ones will be sold / used first and it will value your closing stock accordingly.

Please note,

• if there are not enough items in the FIFO stack to value all stock for an item, the system will use the price of the last delivered item. (Example, if you entered an Actual Closing Stock figure for an item, but it is higher than its Theoretical Closing Stock figure, the extra stock will be valued based on the price of the last delivered item).

• if there are no items in the FIFO stack to value the stock for an item, the system will use the default price of that item. (Example, if you entered an Actual Closing Stock figure for an item, but the item never had a delivery, the stock will be valued based on the default price of that item.)

What is the Stock Variance?

The difference between the Actual Cost and the Theoretical Cost.

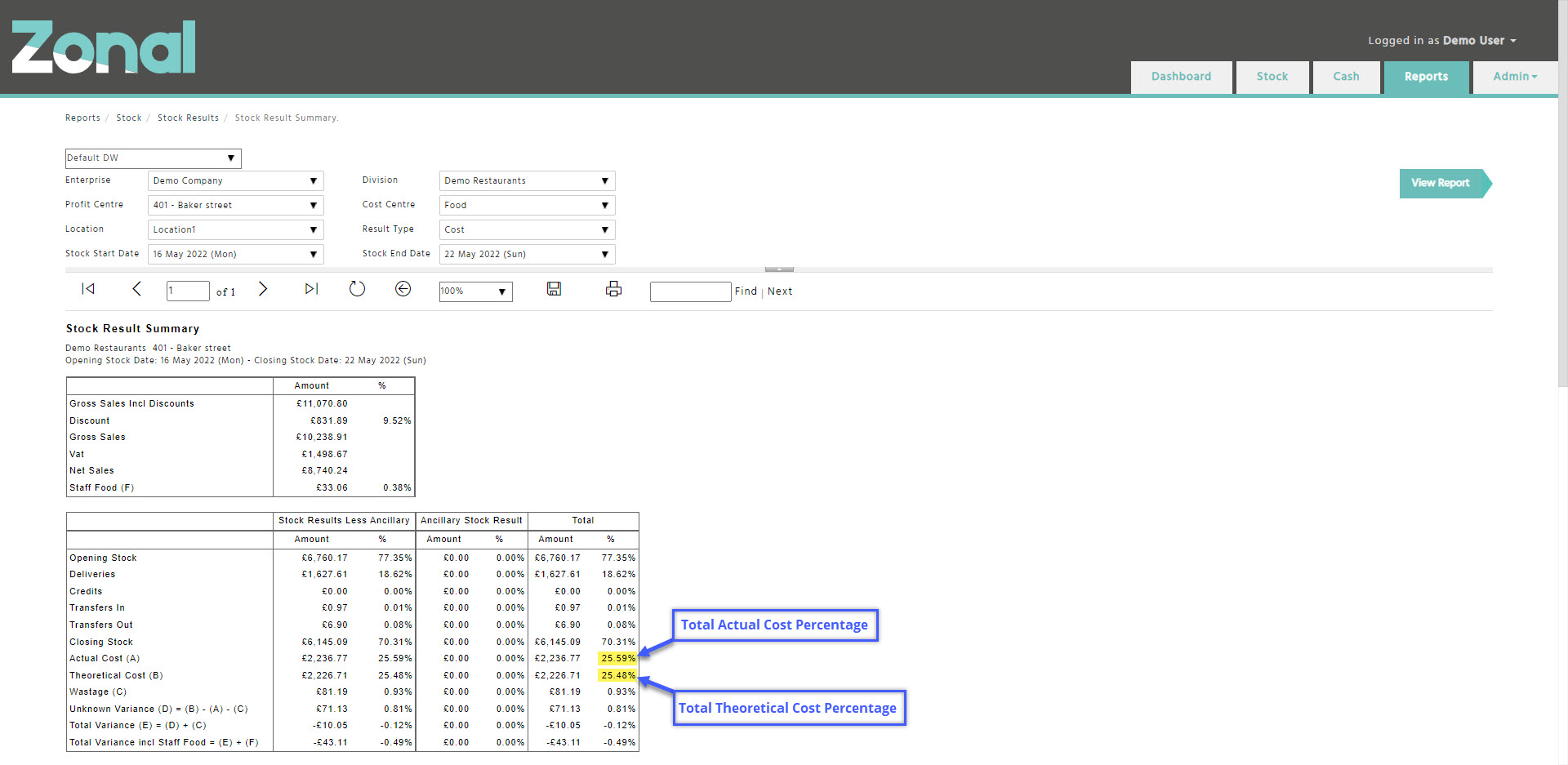

Analysing your stock result by using the ‘Stock Result Summary.’ report

The ‘Stock Result Summary.’ report is made up of series of tables whereby each one shows different information to help you analyse your stock result.

The below tables show you the Sales information and the Staff Food Cost, then it displays the Actual Cost, the Theoretical Cost, and the Total Variance split by Non-Ancillary and Ancillary items.

Total Variance = Unknown variance + Waste

Total Variance % = (Total Variance / Net Sales) * 100

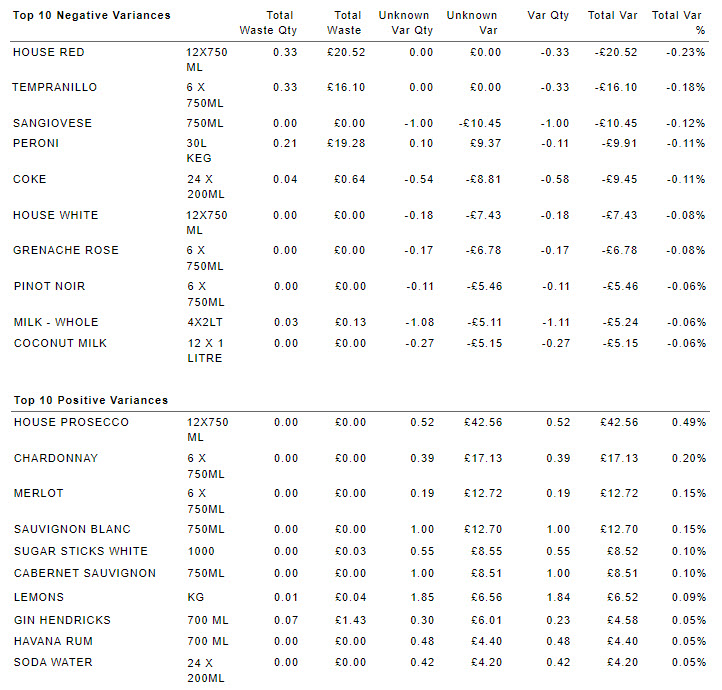

The next table below shows the top 20 negative and the top 20 positive variances.

What do ‘Ancillary’ and ‘Non-Ancillary’ mean?

Non-Ancillary items refer to food and drink items.

Ancillary items refer to chemicals, disposables, etc.

Why do I have variances on certain Stock Items?

This can be caused by several reasons:

• Mistake in Opening stock

• Mistake in Deliveries / Credits / Transfers

• Missing sales

• Mistake in Closing stock

• Mistake in Recipes

Please note, you cannot change the opening stock amounts, and you cannot authorise Recipe changes. This must be done by your head office. Your opening stock is the closing stock from the previous stock period. If this needs to be amended for any reason (such as miscount), the previous stock period will need to be re-opened and then finalised again.

Frequently Asked Questions

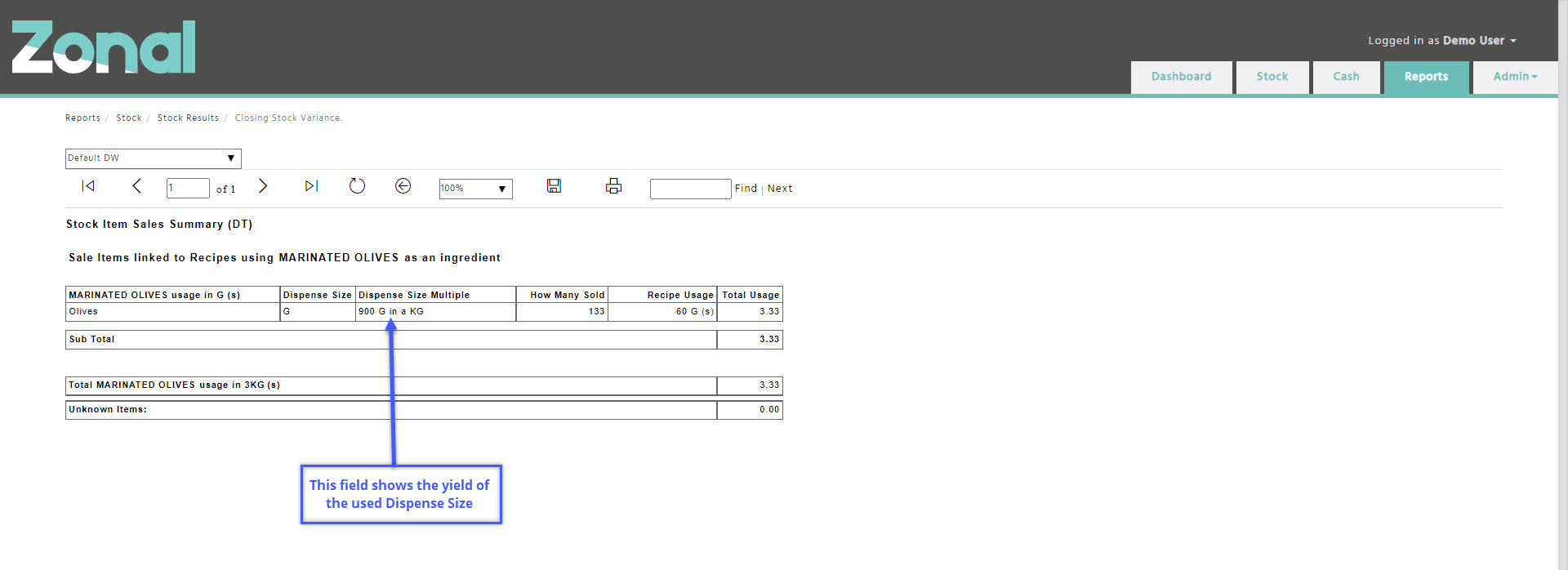

How can I see the yield of a Stock Item?

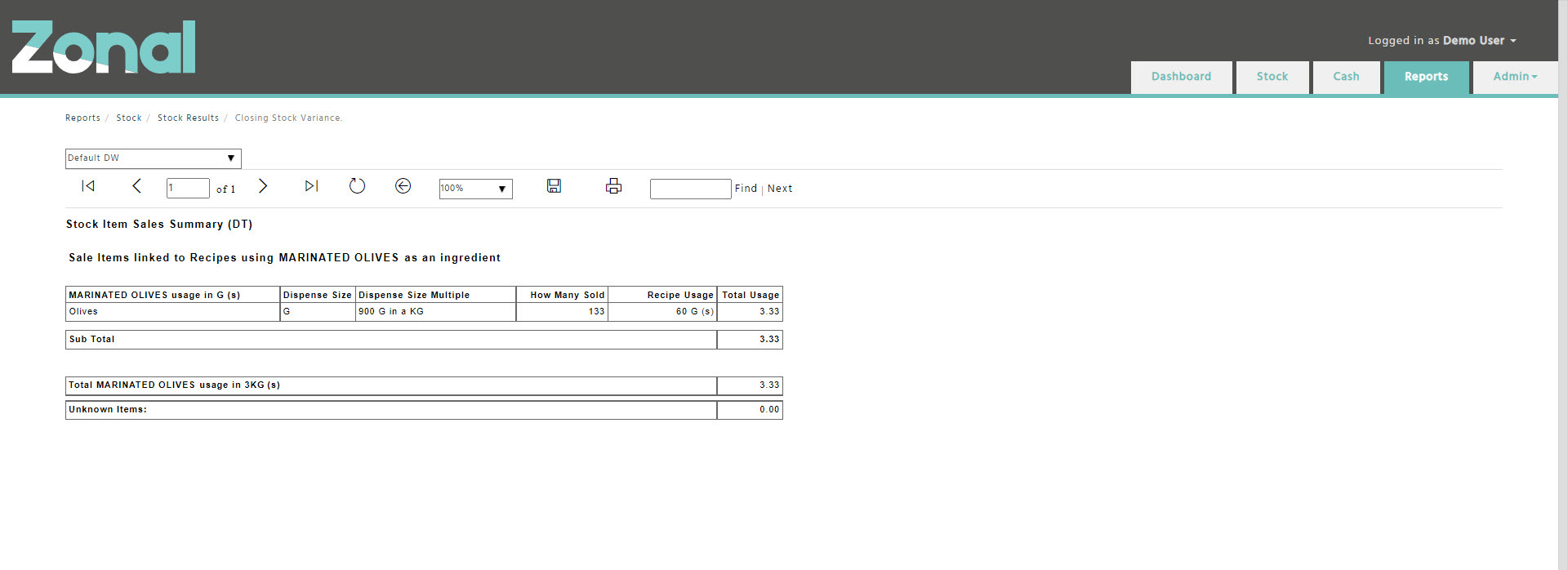

Go to the ‘Closing Stock Variance.’ report and click on the Stock Item’s sales figure.

Once the ‘Sales Summary Drill Through’ report is displayed, you will be able to the see the Stock Item’s yield.

This report will also show you the names of the sold Sales Items, and the Dispense Size and the amount of Stock Item used in a Recipe.

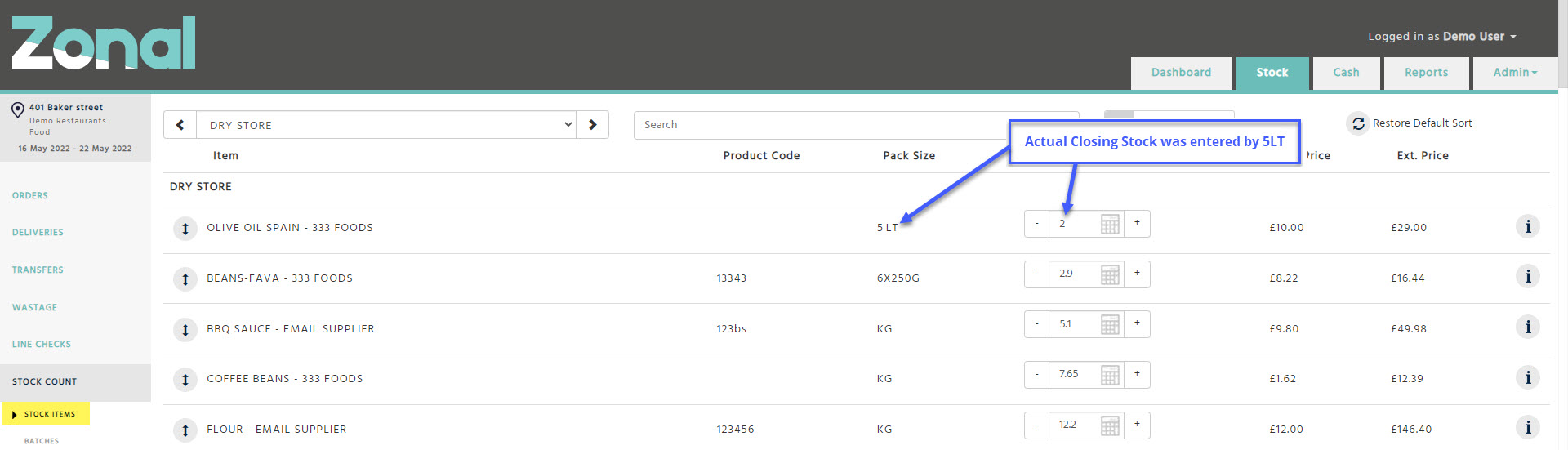

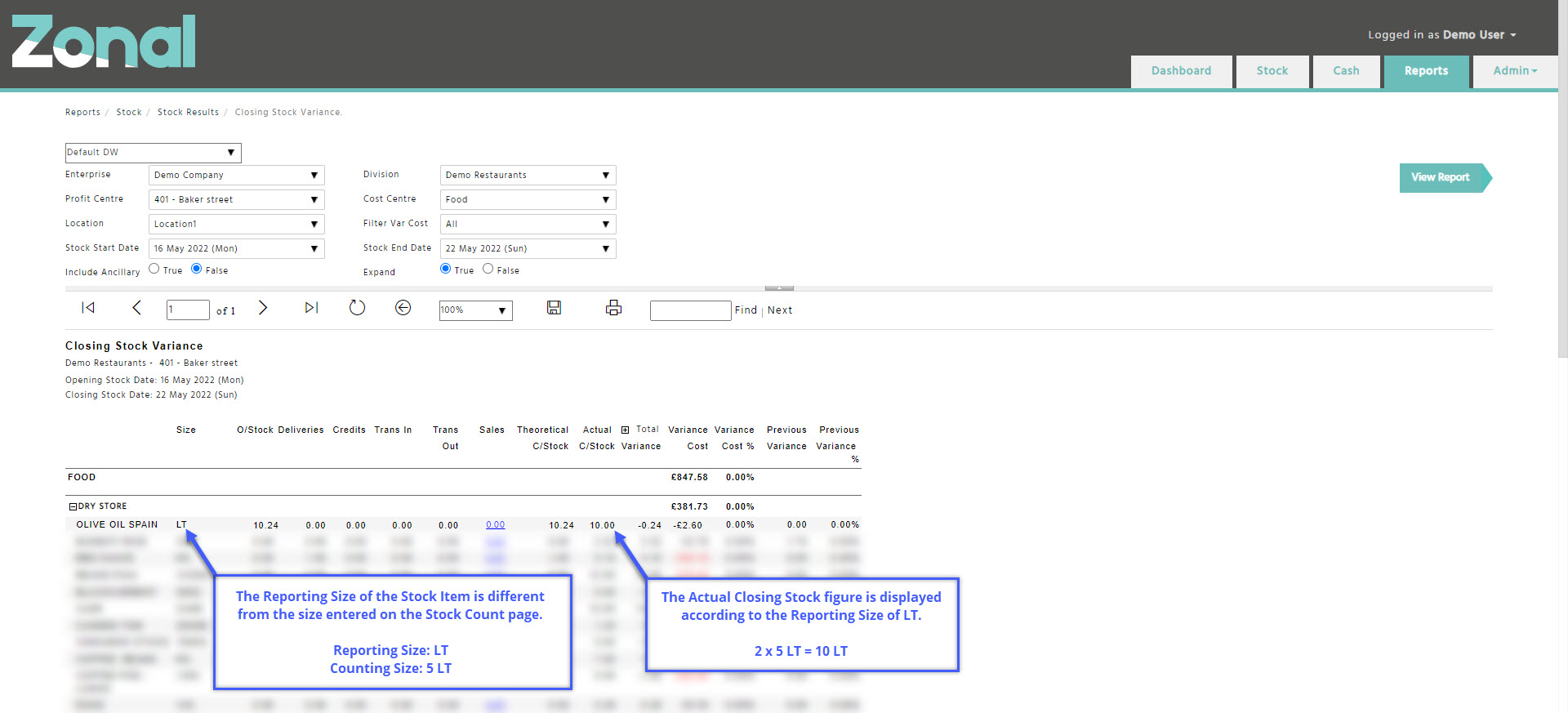

Why is the Actual Closing Stock amount I entered different on the ‘Closing Stock Variance.’ report?

This could be due to the below reasons:

• You have also entered an Actual Closing Stock figure for a Batch that is using the Stock Item.

• The Reporting Size displayed on the ‘Closing Stock Variance.’ report is different from the Counting Size.

How can I check if I have sales for a specific item?

By running the ‘Closing Stock Variance.’ report and clicking on the ‘Sales Summary Drill Through’ report, it will show you the sales of that ingredient. These could consist of multiple Batches within Recipes and as a direct ingredient within a Recipe.

If you know that you have used this item in a Recipe that is not included in this report, contact your stock administrator, and ensure that they have included the ingredient with a Batch or Recipe and ensuring the correct quantity has been added.

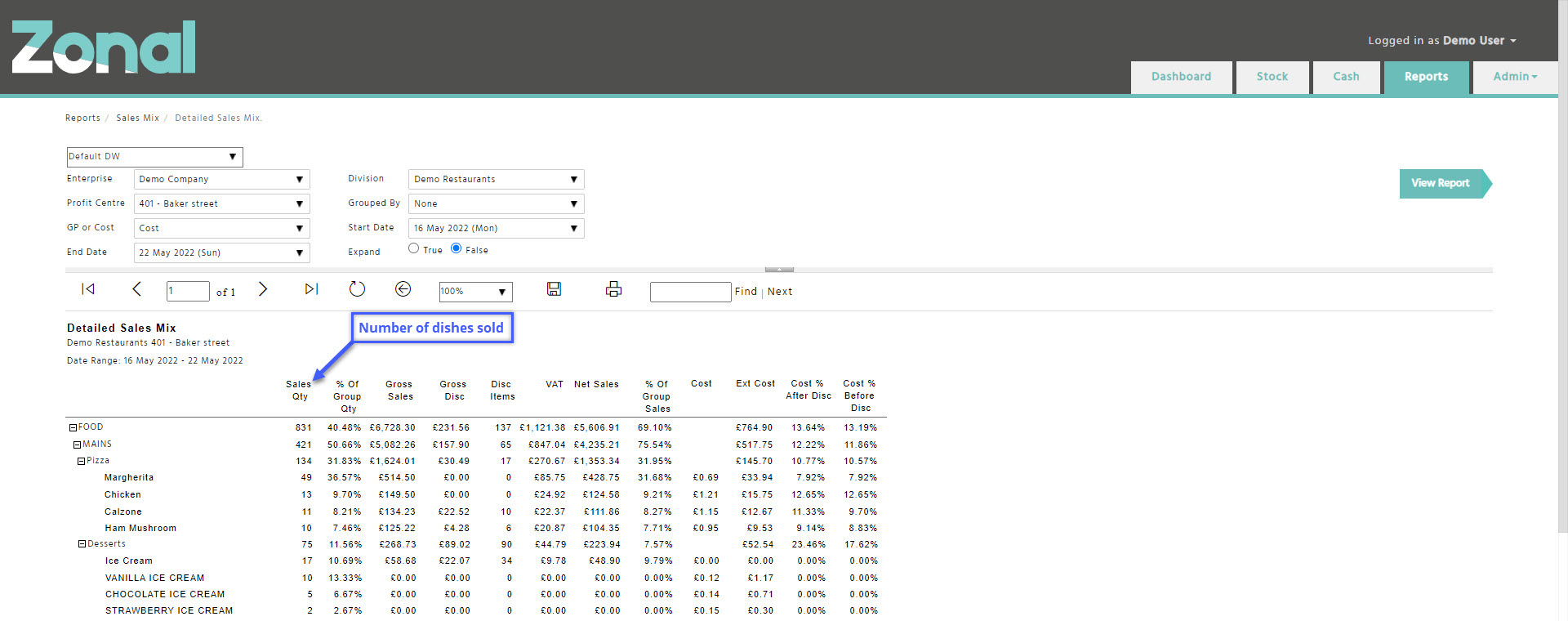

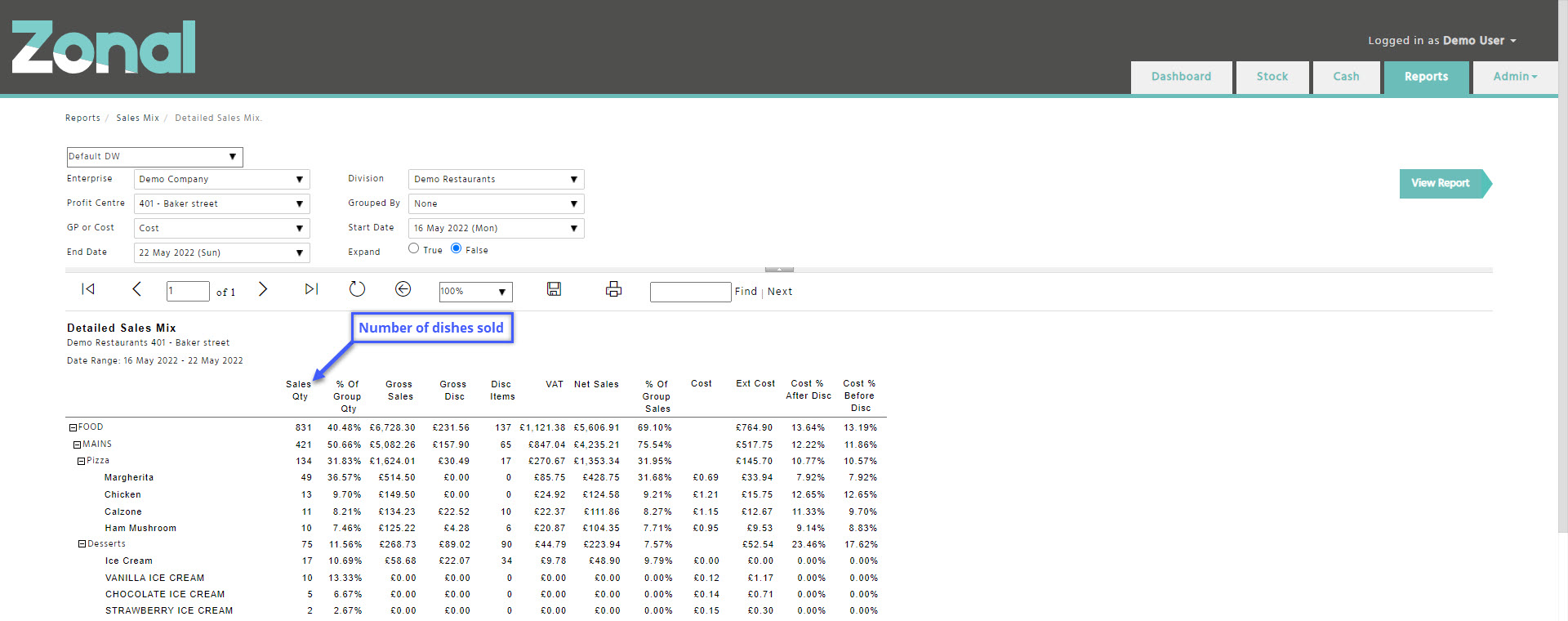

How can I find how many dishes I have sold on a particular day?

Please use the ‘Detailed Sales Mix.’ report that you can find under the Sales Mix folder on the Reports page.

Where can I find the Theoretical Cost of dishes I have sold?

This can also be seen in the ‘Detailed Sales Mix.’ report.

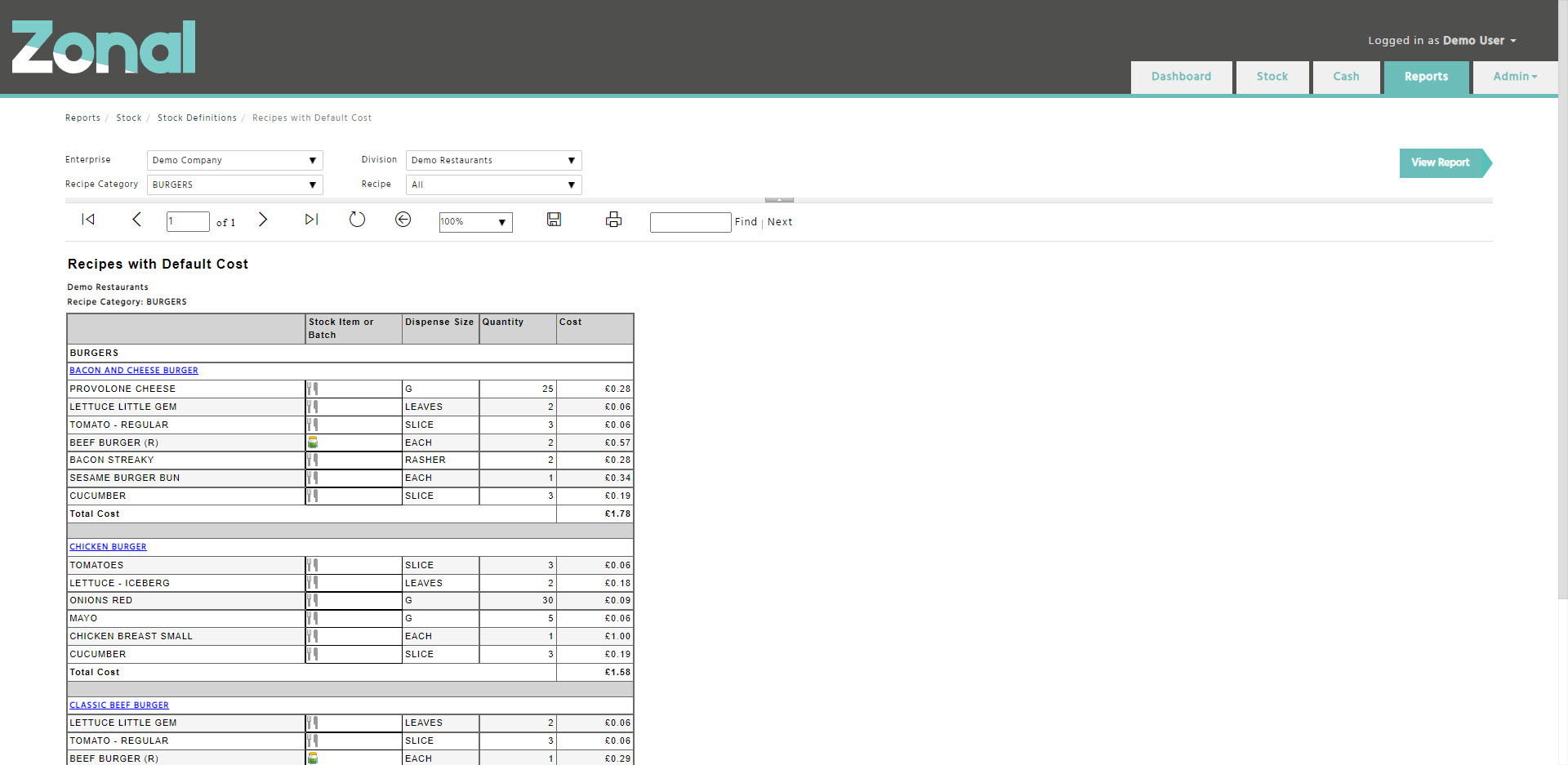

Where can I find the detailed costs of the Recipes?

Please use the ‘Recipes with Default Cost’ report that you can find under the Stock / Stock Definitions folder on the Reports page. The report will display all active Recipes broken down by their ingredients, and it will display the default cost of each ingredient and then the total cost of each Recipe.

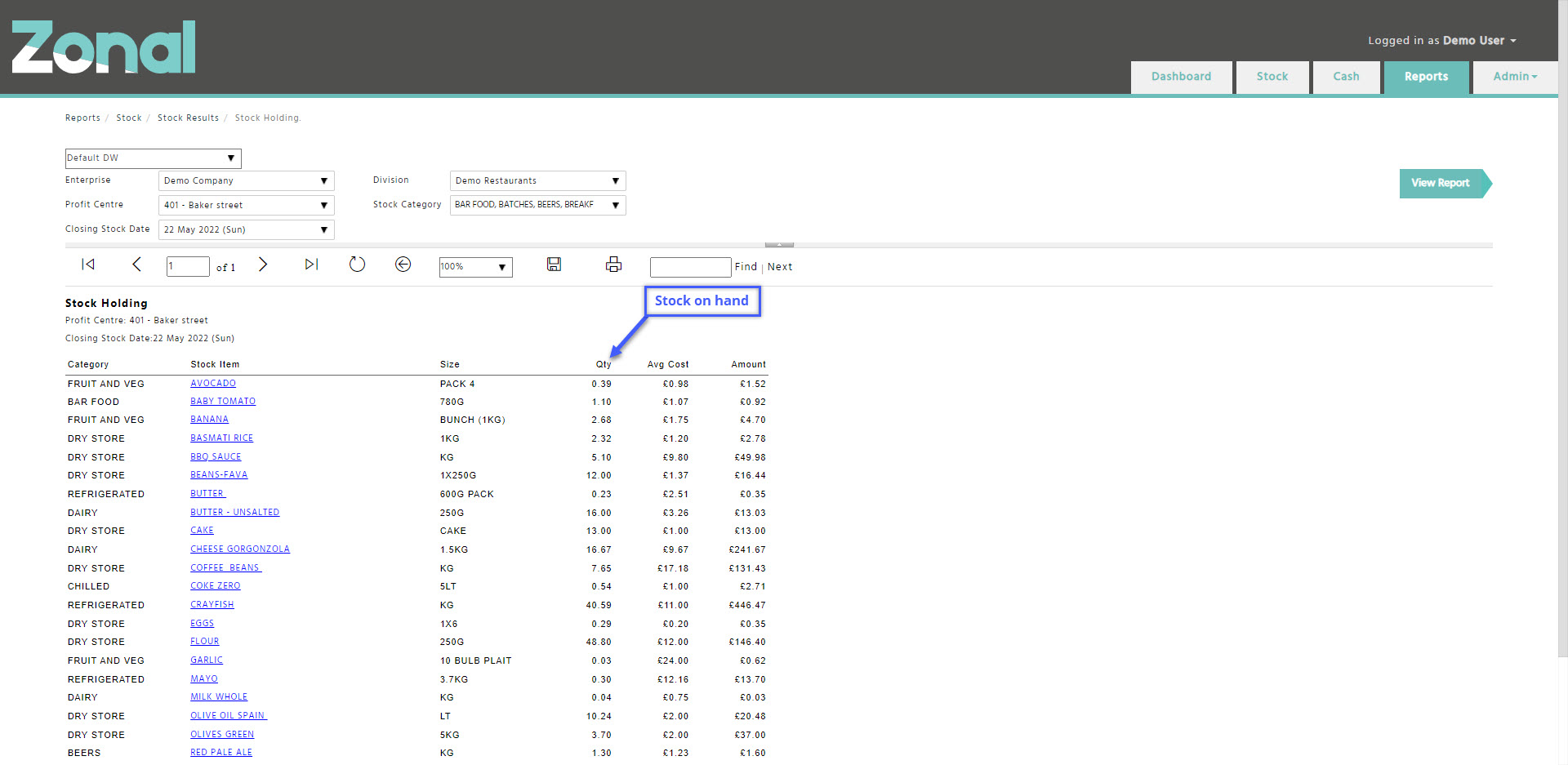

How can I find out what stock I have on hand to help me place orders?

Please use the ‘Stock Holding.’ report that you can find under the Stock / Stock Results folder on the Reports page.

What is the ‘Unknown Amount’ that appears on the ‘Closing Stock Variance.’ report?

When you create a delivery, the system compares the total cost of the items with the entered ‘Invoice Amount’. If there is a difference, the system will automatically add an ‘Unknown Amount’ item to the delivery to match the ‘Invoice Amount’.

Please note, the ‘Closing Stock Variance.’ report displays the ‘Unknown Amount’ based on all your deliveries within your cost centre.

How can I find the unknown variance of a Stock Item?

When you have a variance for a Stock Item, the ‘Closing Stock Variance.’ report will display its total variance. If you expand the column, it will display the variances explained by wastages and the unknown variance in separate columns.

How can I see the variance of my Batches?

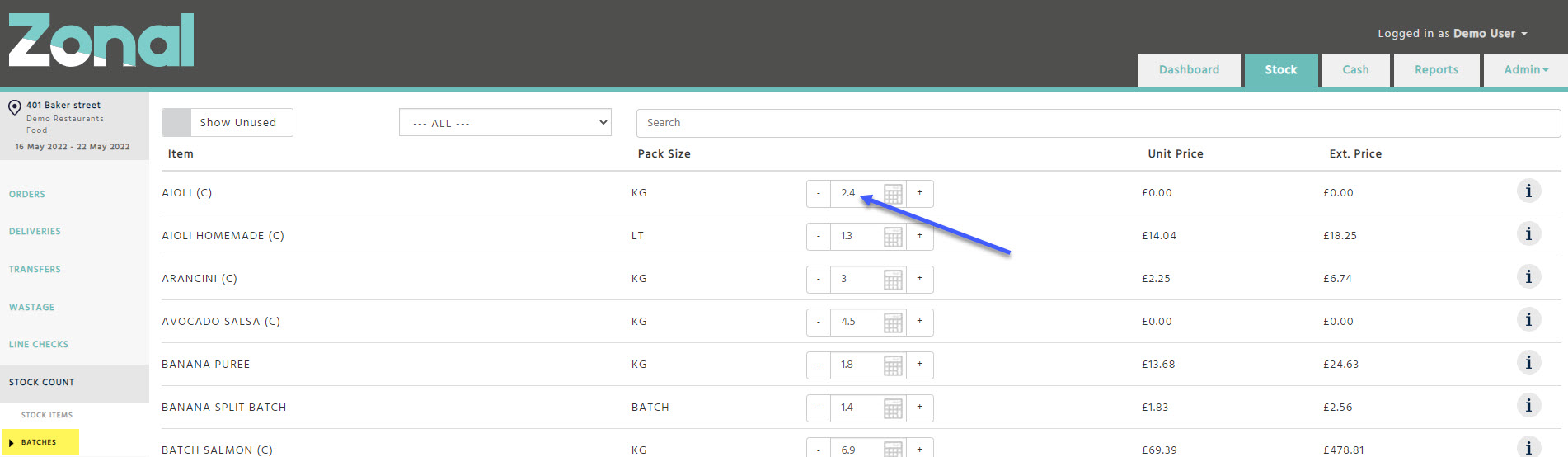

The stock result reports will not show you Batch variances because the system doesn’t know when you prepare your Batches. It is imperative that you count your Batches because the system knows how much you have sold, but not how much you have made.

Why when tallying up my stock count entries ext cost does not show as my exact closing stock amount?

When you count your stock (whether you have chosen to count by category or by supplier), the cost column will show the current system price. When the stock recalculation happens (which happens every 2 minutes), we value the stock based on the FIFO stack.

Why does the total variance not match between the ‘Stock Result Summary.’ and the ‘Closing Stock Variance.’ reports?

It does, however, it is a combination of all stock departments within your cost centre, so you will need to look at the last row on the last page of the ‘Closing Stock Variance.’ report.

Why do I need to transfer and count items by Supplier Products instead of Stock Items?

The system can be configured to count by categories or by suppliers for each client, therefore transferring and counting items on supplier product level is required.

If counting by category, this allows the user to define the supplier they prefer to count. The stock will always be valued by the FIFO stack which is defined by the price of the items as they were delivered at.