If the electronic invoice does not arrive from the supplier before the end of the current stock period, you can create an Accrual from an order and you will be able to finalise your stock on time. Please note, the order must have already been sent to the supplier.

When the electronic invoice does arrive in the current stock period, it will match up with the corresponding order and it will replace the Accrual you have created. You will need to accept the electronic invoice manually as usual.

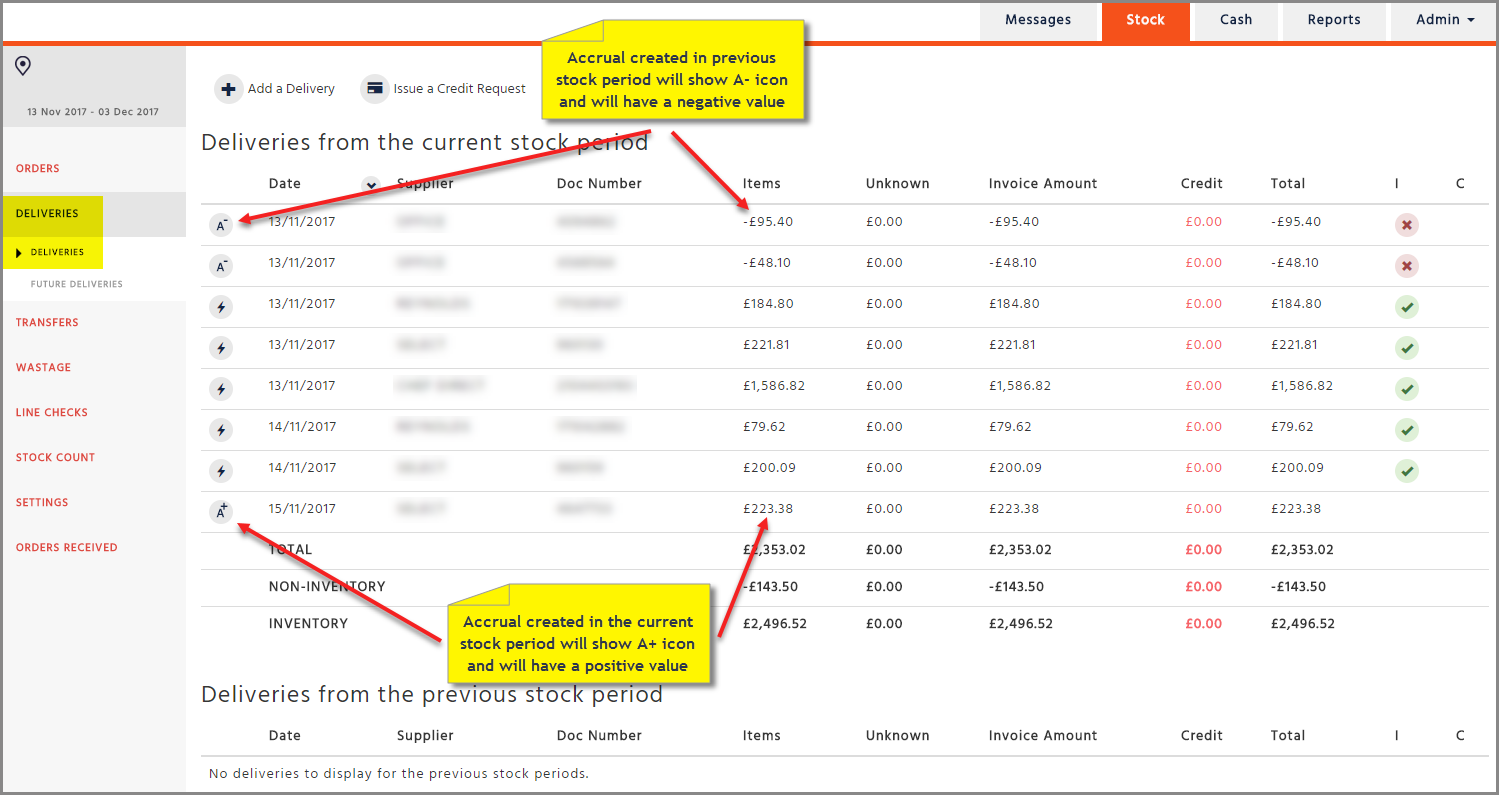

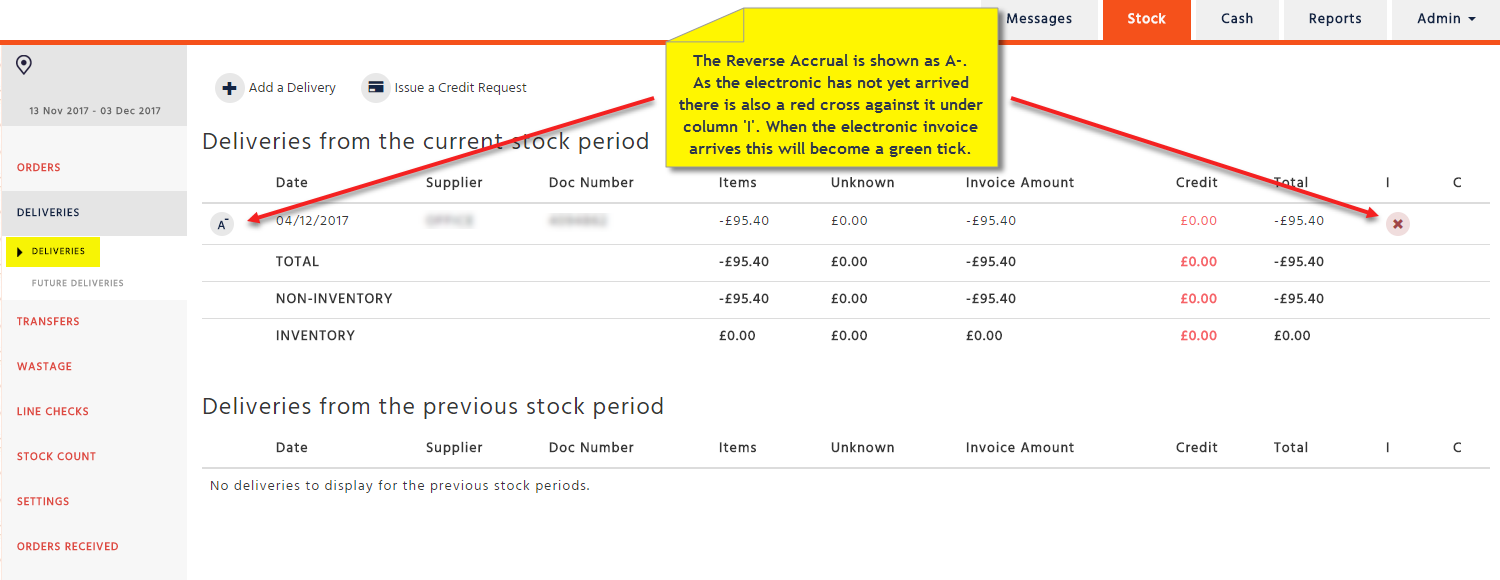

If the electronic invoice does not arrive in the current stock period, when you finalise your stock period, the Accrual you have created will appear in the next stock period automatically as a Reverse Accrual with a negative value. When the electronic invoice arrives into the next stock period this will balance the Reverse Accrual, the Reverse accrual will be automatically accepted and you will need to accept the electronic invoice manually as usual.

If you would like to carry out a line check and the electronic invoice has not yet arrived for a delivery you have received, you could create an Accrual for that order enabling you to check your stock. However, please note, if you are not doing a line check and you know that the electronic invoice will be coming in during your current stock period it is not necessary to create an Accrual.

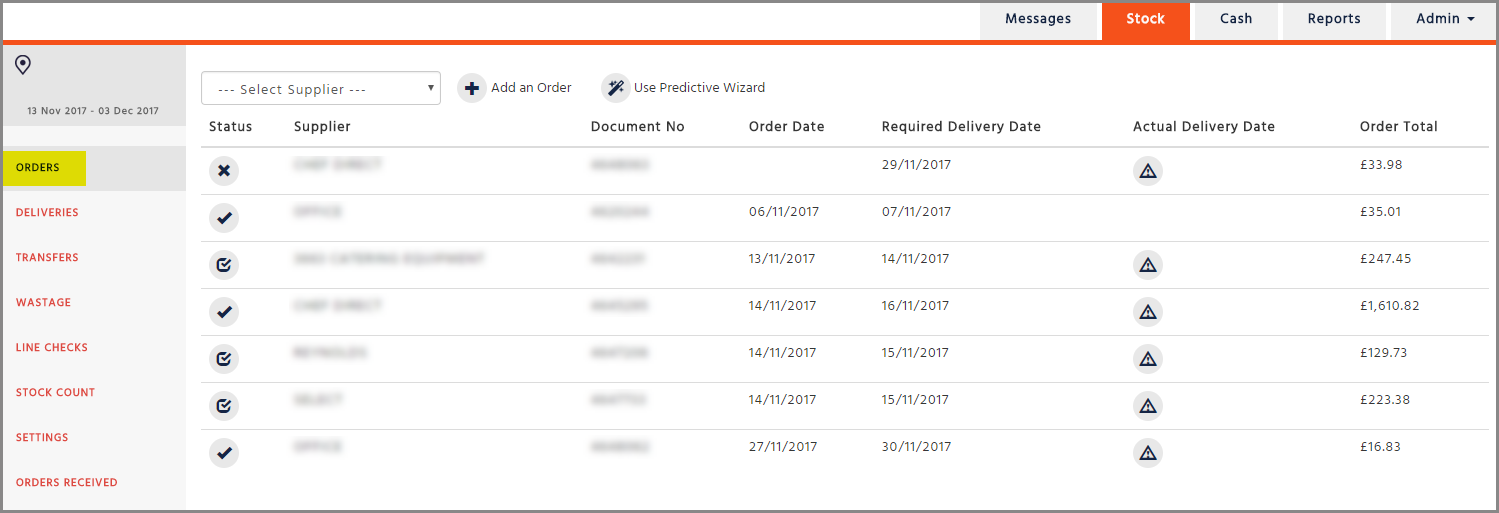

If an electronic invoice has not yet arrived for an order and the ‘Required Delivery Date’ has arrived then a warning triangle will be displayed in the ‘Actual Delivery Date’ column indicating that an Accrual might be needed.

Please note that you cannot create an Accrual for an order if the ‘Required Delivery Date’ is in a future stock period.

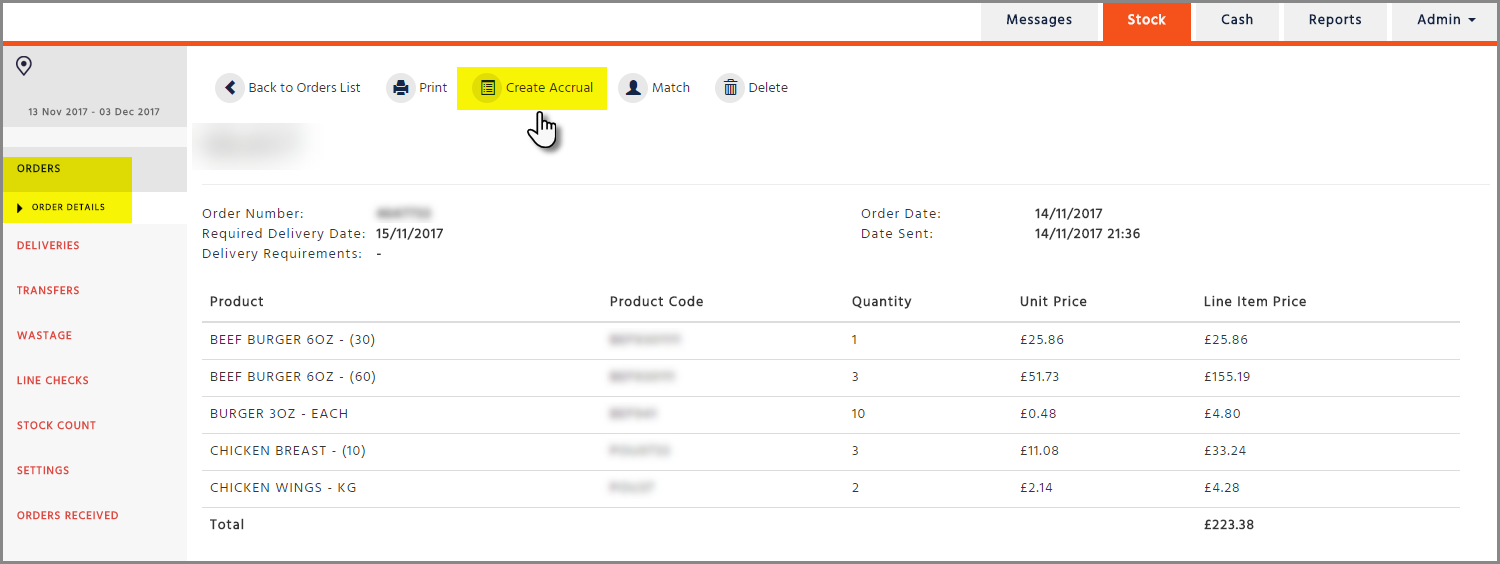

Creating an Accrual from the 'Orders' page

-

Go to the ‘Orders’ page and click on to the order you wish to create an Accrual for, then select the ‘Create Accrual’ button

-

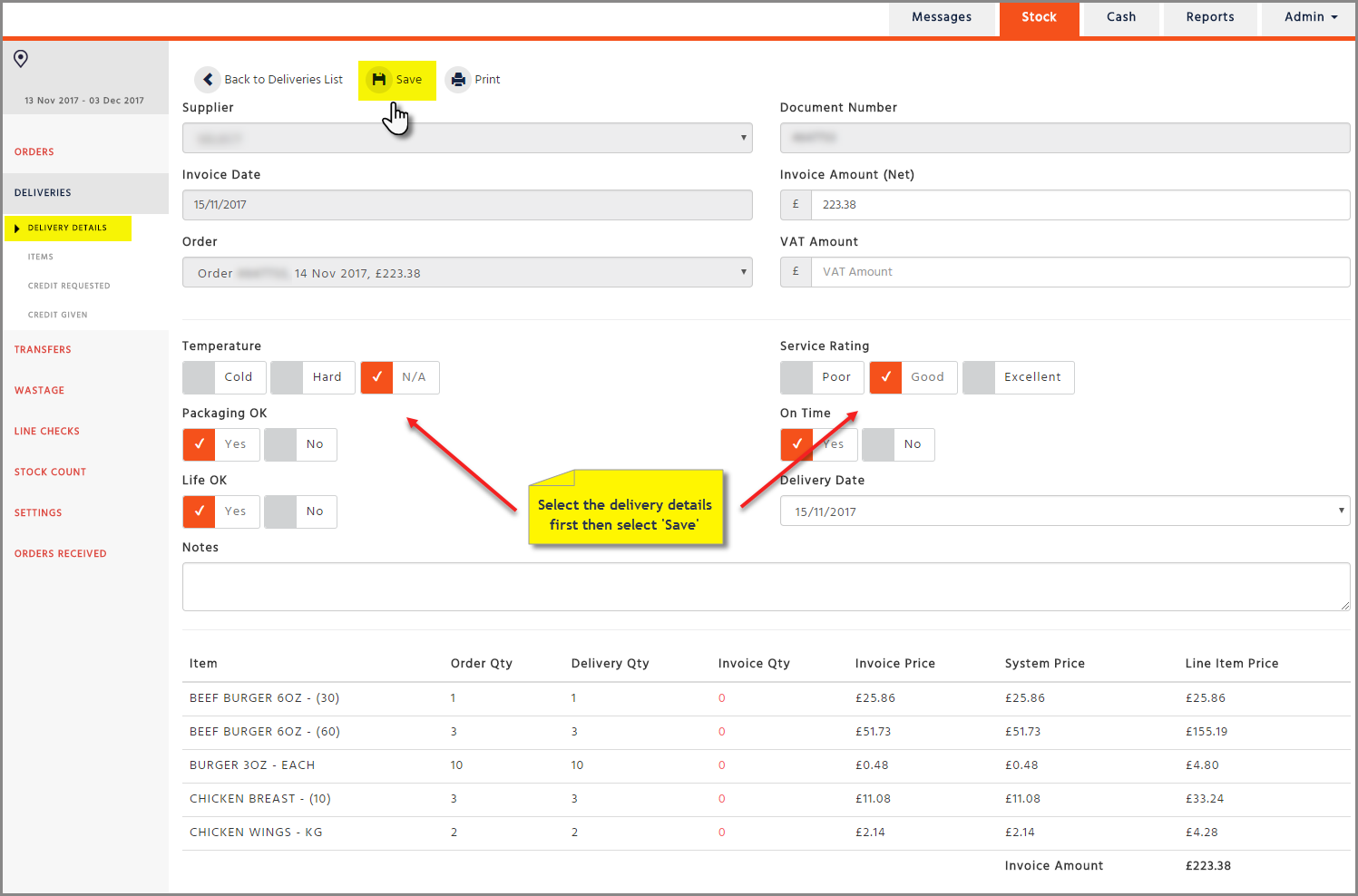

Enter the delivery details of the Accrual (e.g.: ‘Temperature’, ‘Service Rating’) then press ‘Save’

-

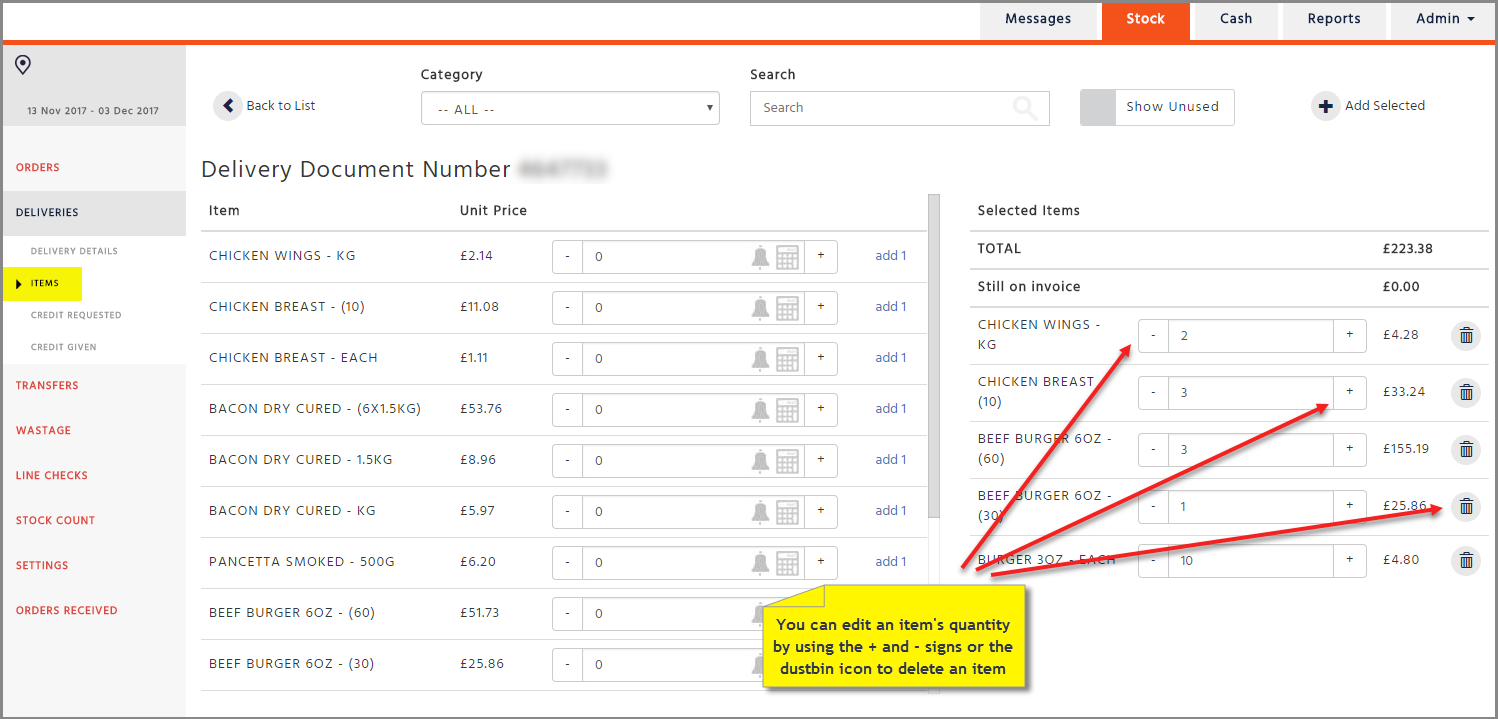

Go to the ‘Items’ page on the left-hand side and edit the Accrual if necessary (according to what was actually delivered). Please note that credit requests cannot be raised on an Accrual

-

Go back to the ‘Deliveries’ page where the Accrual can be viewed

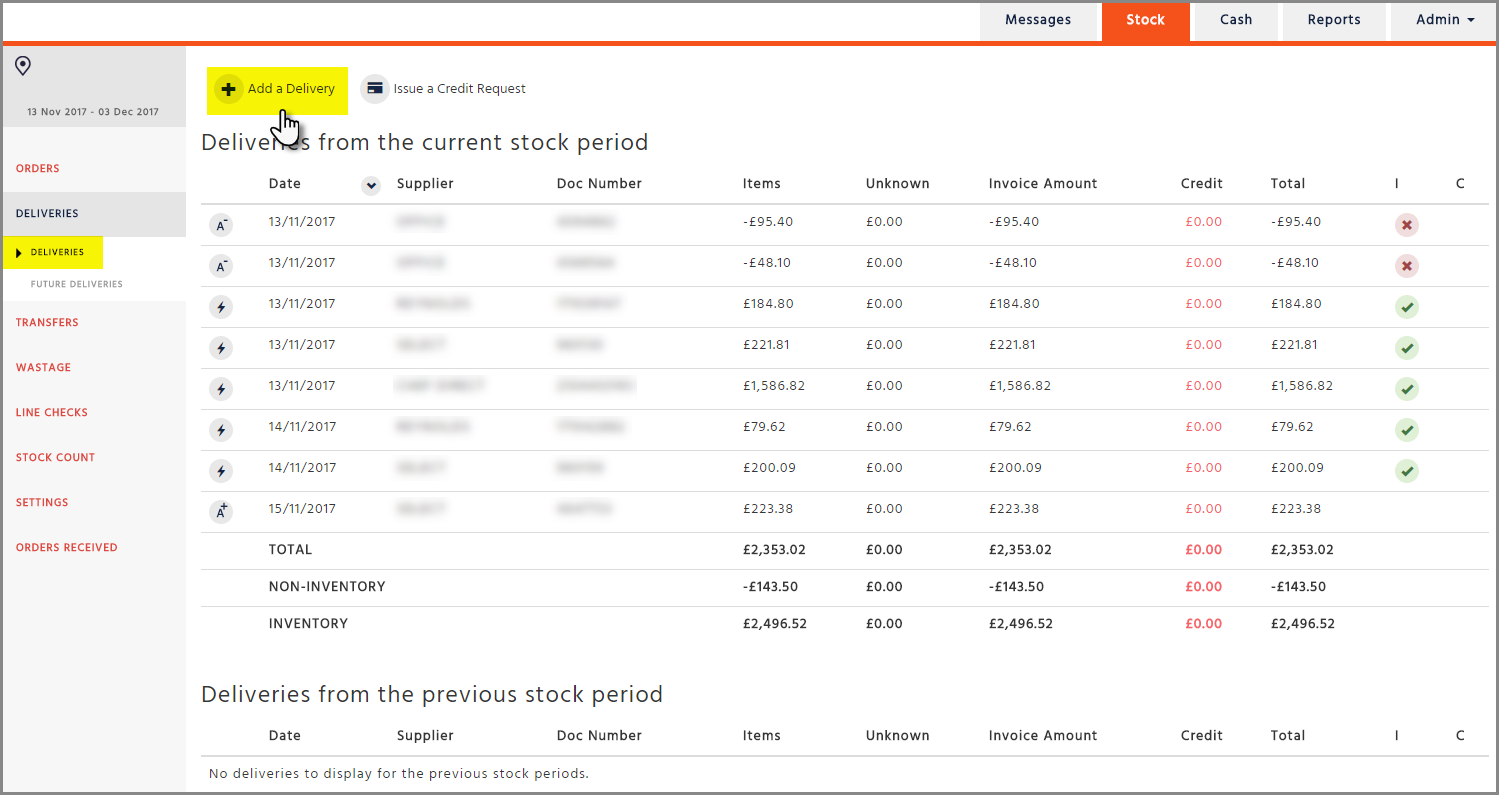

Creating an Accrual from the 'Deliveries' page

-

Go to the ‘Deliveries’ page and select ‘Add a delivery’

-

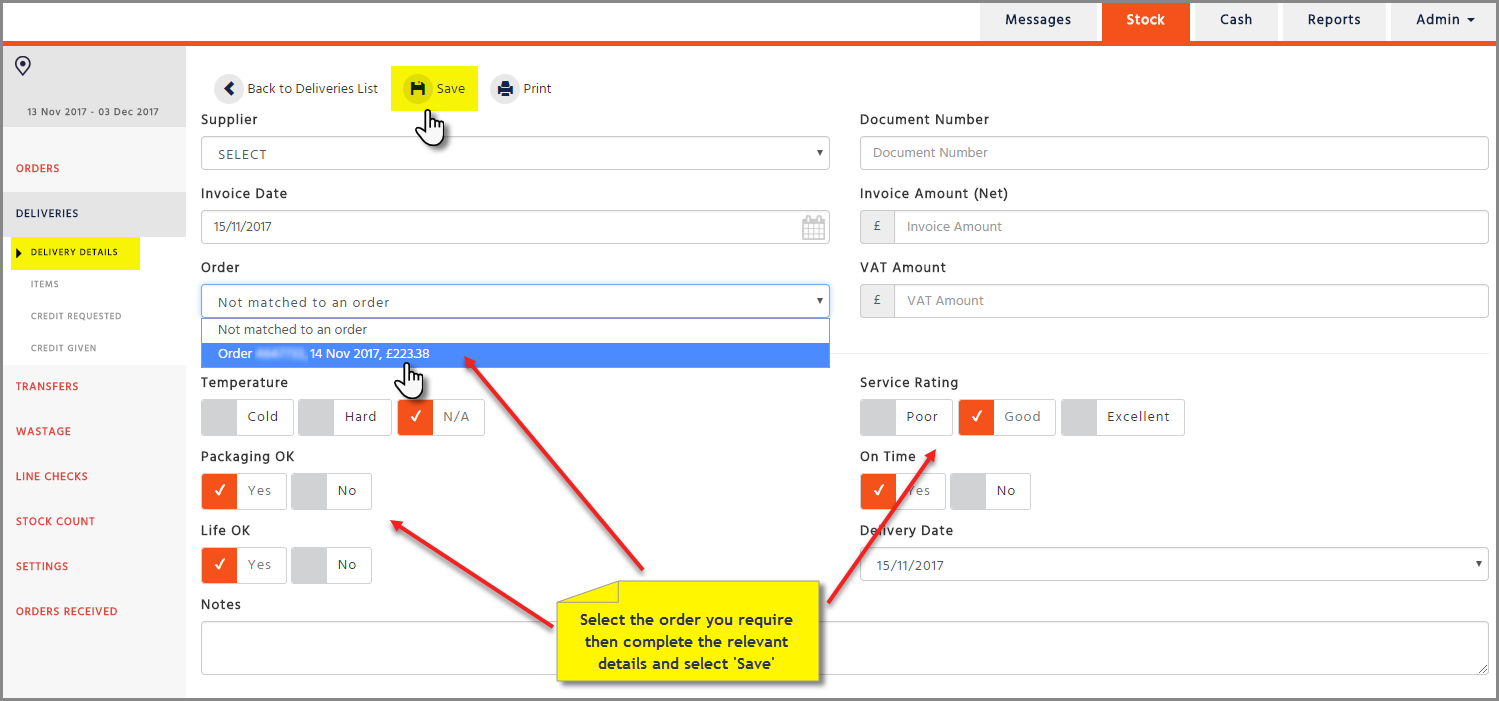

Select the supplier and invoice date (Required Delivery Date). Any orders for that supplier and date will automatically appear under the ‘Order’ drop down list. Select your order from here where you can also see the details of the document number and invoice amount. Enter the rest of the delivery details (e.g.: ‘Temperature’, ‘Service Rating’) then select ‘Save’

-

Go to the ‘Items’ page on the left-hand side and edit the Accrual if necessary (according to what was actually delivered)

Note that credit requests cannot be raised on an Accrual

-

Go back to the ‘Deliveries’ page where the Accrual can be viewed

Reverse Accruals - The Electronic Invoice does not Arrive in Current Stock Period

If an electronic invoice has not been received again, the Reverse Accrual can be deferred to the next stock period, on or after the last day of the current stock period.

Deferring a reverse accrual to the next stock period will make your stocks for the current week more accurate when checking reports, however, if the related electronic invoice is received in your current week you must ensure that the electronic invoice is also deferred to the next stock period so that both the invoice and reverse accrual are in the same stock period. If this does not happen then you will have an invoice in one stock period and reverse accrual in another and this will create variances in your stock

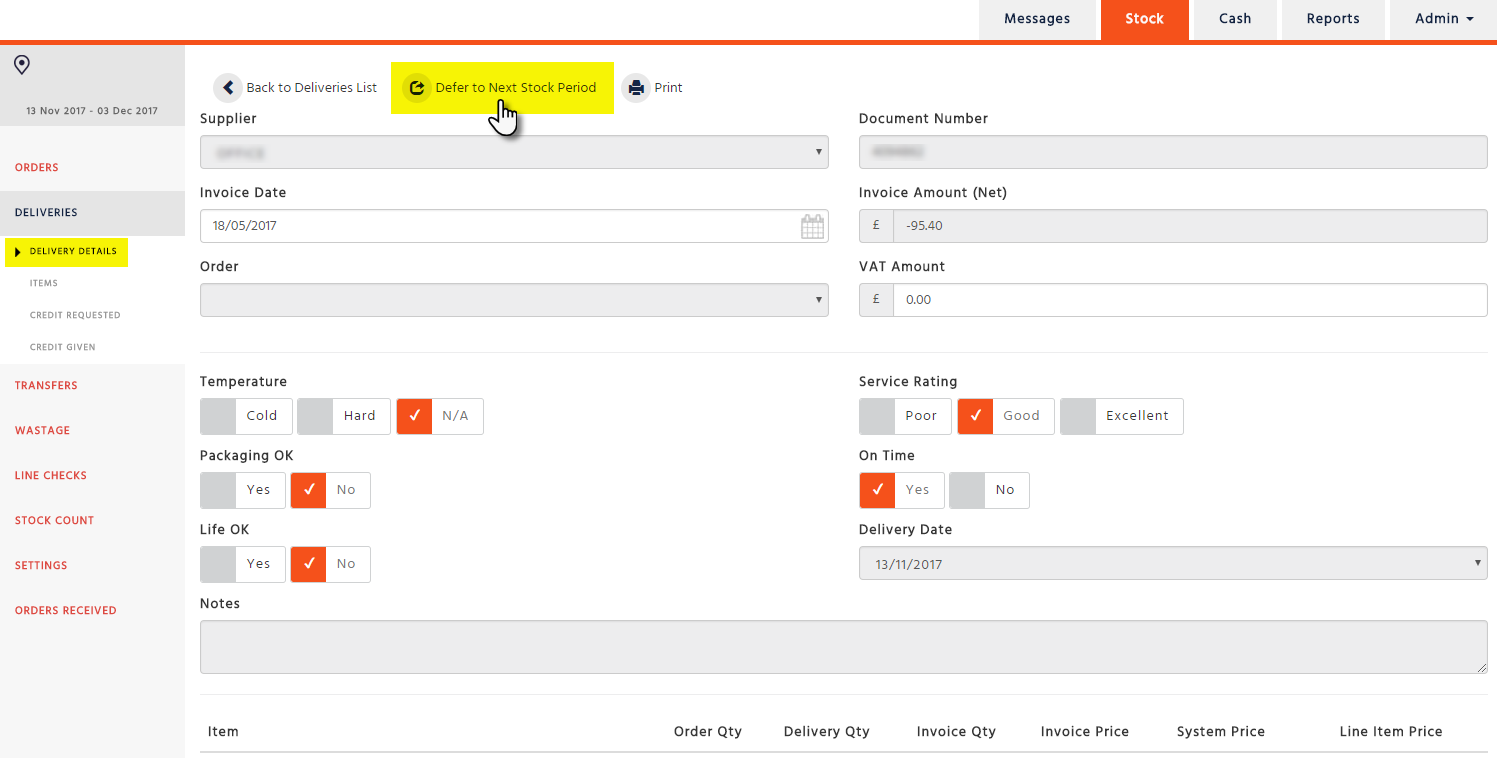

Go into the Reverse Accrual and press the ‘Defer to Next Stock Period’ button.

The deferral of this Reverse Accrual can continue for several weeks. If your Head Office believes that the electronic invoice will never arrive from the supplier then they can manually accept it.